HWWI Commodity Price Index reports strongest growth since March

Energy prices boost index

- Overall HWWI index rises by 9.4% in October (dollar base)

- Crude oil prices increase by 10.1%

- Natural gas and coal prices also surge

(Hamburg, 3rd November 2016) After the stagnation of the past two months, the HWWI Commodity Price Index recorded an overall increase of 9.4% in October in comparison to the previous month (in euro: 11.4%). The increase is mainly due to the rise in energy prices (+10.7%; in euro: +12.7%). The announcement of a crude output limit contributed to an upsurge on the oil markets. The indexes for natural gas and coal also rose considerably – 10.1 % (in euro: +12.1%) for natural gas and 26.2% (in euro: +28.5%) for coal. Prices for industrial raw materials increased by 2.7% (in euro: +4.6%). The index for food and luxury goods also rose by 1.2% (in euro: +3.0%).

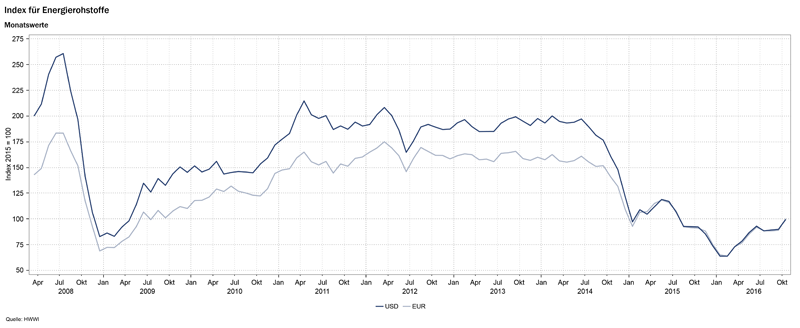

Energy resource index: +10.7% (in euro: 12.7%)

The recent developments in the oil markets led to a price increase of 8.7% in Brent Crude’s monthly average. The price was briefly just under US$53 per barrel but fell to around US$49 at the end of the month. In an informal meeting at the end of September, the OPEC countries agreed to limit production to 32.5 million barrels per day, 750,000 barrels less than in August. However, whether oil prices will rise in the medium term remains uncertain. On the one hand, how the output limit is spread over individual countries is unclear, as is whether Russia will also be limiting its production; on the other hand, the reduction only corresponds to 0.8% of the daily world production, an amount that could be offset by the US. Higher prices also make cost-intensive oil recovery methods profitable. Therefore, over the past few weeks, US oil production has been increased by fracking, which should keep the global supply stable.

In addition to oil prices, coal and European natural gas prices have also risen. The coal index reacted to the drastic production cuts in China with an upsurge of 26.2% (in euro: +28.5%). At ICE Futures in London, lower imports from Norway and the Netherlands as well as forecasts for low temperatures aroused fears of natural gas shortages. As a result, the UK Natural Gas Index increased by 28.3% (in euro: +30.6%).

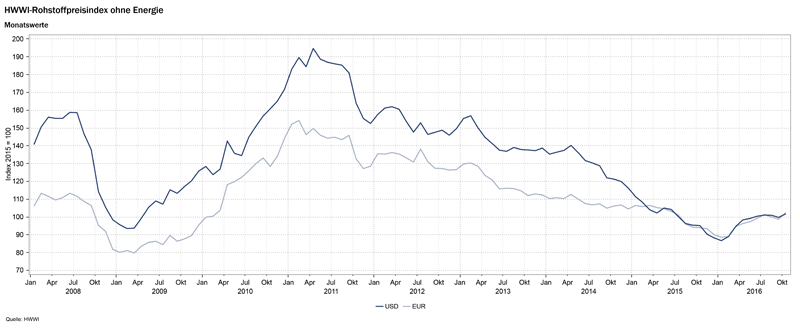

Industrial raw materials index: +2.7% (in euro: +4.6%)

The changes for industrial raw materials were much less significant but nonetheless largely positive. The aluminium price continued its upward trend as of mid-September and was 4.7% (in euro: +6.6%) above the previous month’s average. Stricter transport regulations for aluminium in China had contributed to delays in delivery. The price of iron ore also rose by 2.6% (in euro: +4.5%). At the end of the month it was at its highest point in six months after the largest exporters, Vale and Rio Tinto, had reduced their production forecasts. As a result of falling inventories and a stable demand, lead prices continue their upward trend as in the previous months (+5.0%, in euro: +6.8%).

Index for food and luxury goods: +1.2% (in euro: +3.0%)

In October, prices for food and luxury goods offered a mixed picture. While the indexes for grains and luxury goods were up, the index for oilseeds and oils fell slightly. Difficult weather conditions in the largest export country, Brazil, are forecasting a bad harvest and rising prices for coffee (+3.5%, in euro: +5.3%) and sugar (+7.7%, in euro: +9.6%). After the harvest in the US – which is almost complete – failed to meet high expectations, corn prices rose by 6.5% (in euro: +8.4%). In Malaysia, on the other hand, declining exports to China and India have led to a decrease in palm oil prices (-6.2%, in euro: -4.5%).